Connolly, Scott, Beyer and McEachin Call on House Republicans to Protect the State and Local Tax Deduction

Washington,

October 31, 2017

Tags:

Economy

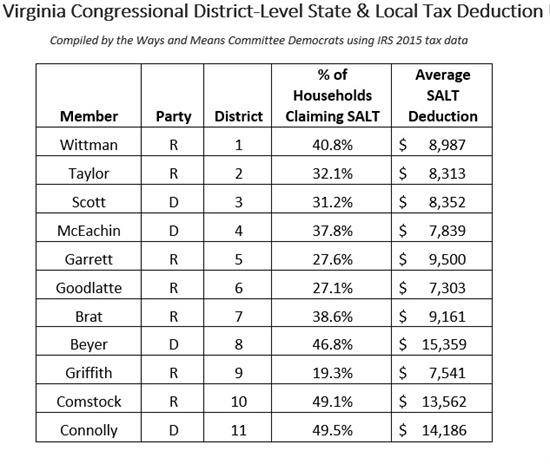

Today, Virginia Representatives Gerry Connolly, Robert C. “Bobby” Scott, Donald S. Beyer, Jr., and A. Donald McEachin called on House Republicans to protect the state and local tax deduction. In Virginia, 1.5 million households claim $16.5 billion in SALT deductions for an average deduction of $11,288 per household. Virginia has the nation’s 4th highest percentage of tax filers claiming a SALT deduction (37%). “This is a bad deal for Virginians who are being asked to pay even more just so House Republicans can give massive tax cuts to the top one percent,” said Congressman Gerry Connolly. “Eliminating the SALT deduction would increase taxes on more than 1.5 million Virginia families, including 700,000 Northern Virginia households, and threatens our growing economy.” “The Republicans’ proposed tax plan is little more than a giant tax cut for the wealthy masquerading as tax reform. Instead of helping working families succeed and ensuring that our economic recovery reaches every community, the President and Republicans in Congress are insisting on tax cuts at the expense of the very people they are claiming to help,” said Congressman Bobby Scott. “Eliminating the state and local tax deduction to pay for part of the regressive Republican tax plan would be bad for middle class families across the country, but it would hit Virginians particularly hard,” said Congressman Don Beyer. “Over a third of Virginia families use it to claim, on average, over $11,000 in deductions on their tax filings. Hiking taxes on middle class families to pay for tax cuts that mostly go to millionaires and billionaires would be immoral.” “Eliminating the SALT deduction would mean that the 115,900 households in the 4th Congressional District would get a bad deal for the sake of the wealthy one percent of Americans,” said Congressman Donald McEachin. “I cannot stand by while congressional Republicans turn their backs on my constituents. I urge Chairman Brady and his fellow Republicans to abandon their path to neglect middle-class families.”

Last week, the members sent a letter to House Ways and Means Committee Chairman Kevin Brady in support of the SALT deduction. “We are committed to the state and local tax deduction and will oppose tax reform legislation that repeals this important part of the United States tax code and harms the family budgets of middle income households,” they wrote. “We want smart tax reform that creates new economic opportunities for American families…However, repeal of the state and local tax deduction does not help us accomplish these important objectives. In fact, such a proposal would upend family budgets in Virginia.” The full text of the letter follows and is available here. The Honorable Kevin Brady Dear Chairman Brady, We write to you on behalf of the taxpayers of the Commonwealth of Virginia to share our concern about plans to eliminate the state and local tax (SALT) deduction. We are committed to the SALT deduction and will oppose tax reform legislation that repeals this important part of the United States tax code and harms the family budgets of middle income households. In the Commonwealth, 1.5 million households claim $16.5 billion in SALT deductions for an average deduction of $11,288 per household. Virginia has the nation’s 4th highest percentage of tax filers claiming a SALT deduction (37%). Residents of Fairfax County, Virginia alone claim nearly $4.62 billion in SALT deductions. Nearly 100,000 tax filers in Loudoun County benefit from an average SALT deduction of $14,986. In Buckingham County, 95 percent of tax filers claiming the SALT deduction are middle income households. The SALT deduction helps the residents in these counties build better schools, invest in transportation improvements, and support law enforcement and public safety agencies. We are especially concerned that repeal of the SALT deduction could harm home ownership in our districts. Repeal would make homes less affordable for more than 100,000 middle income filers in Chesterfield, Stafford, and Roanoke Counties, and could cost people their homes if families are no longer able to deduct their property taxes. We want smart tax reform that creates new economic opportunities for American families. However, repeal of the SALT deduction does not help us accomplish these important objectives. In fact, such a proposal would upend family budgets in Virginia. We commend your efforts to enact meaningful tax reform. We believe the SALT deduction is an important part of a simple and competitive tax code, and we urge you not to repeal it in future tax reform legislation. Sincerely, |

In the News

SUBSCRIBE

SUBSCRIBE

Sign up to get news and updates from Rep. Gerry Connolly directly to your inbox.